FAQ: MarketWise Buyout Proposal from Monument & Cathedral Holdings

Summary

MarketWise has received an unsolicited $17.25-per-share cash buyout proposal from Monument & Cathedral Holdings to acquire all outstanding shares it doesn't already own. The company's board is currently reviewing the proposal, which may or may not lead to a transaction.

What is the main news about MarketWise?

MarketWise received an unsolicited takeover proposal from Monument & Cathedral Holdings to acquire all outstanding shares it doesn’t already own for $17.25 per share in cash.

Who made the buyout proposal to MarketWise?

The proposal came from Monument & Cathedral Holdings LLC and its affiliates, who already own some shares of MarketWise.

What is the offer price per share in the buyout proposal?

The offer is for $17.25 per share in cash for all outstanding equity interests not already held by Monument & Cathedral Holdings.

What are the conditions of the buyout proposal?

The proposal is contingent on the termination of MarketWise’s tax receivable agreement, which would need to be resolved for the transaction to proceed.

How is MarketWise responding to the proposal?

MarketWise’s board is reviewing the proposal with its financial and legal advisers, and the company emphasized that the approach may or may not lead to an actual transaction.

What does MarketWise do as a company?

MarketWise is a Baltimore-based provider of subscription-based financial research and investor education tools, operating a portfolio of investment research and analysis brands that serve self-directed investors.

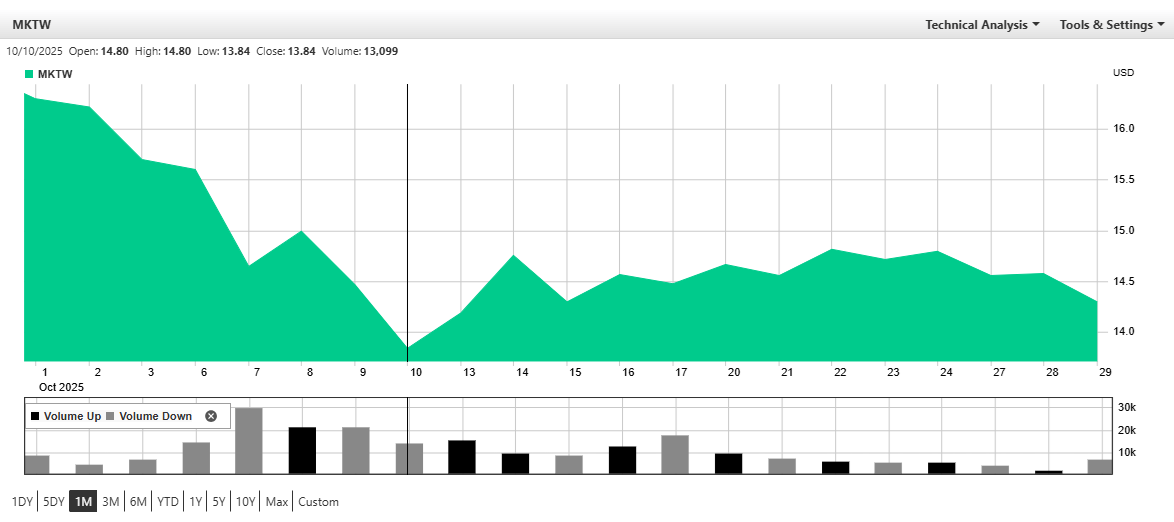

When did MarketWise go public and where does it trade?

MarketWise went public in 2021 through a SPAC merger and its shares trade on the Nasdaq under the ticker symbol MKTW.

Will MarketWise provide regular updates about this proposal?

No, MarketWise stated it does not intend to provide further updates unless it enters a definitive agreement or is otherwise required by U.S. securities laws.

What types of products and services does MarketWise offer?

MarketWise generates revenue through paid subscriptions, premium memberships, and software tools that provide market insights, trading strategies, and portfolio tools for investors.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 269605