FAQ: ITS Logistics October Port Rail Ramp Index - Import Volume Decline and CDL Regulatory Impact

Summary

The ITS Logistics October Port Rail Ramp Index reveals continued low import volumes and new FMCSA restrictions on non-domiciled CDLs, which are removing lower-cost capacity from the market and increasing financial risks for carriers during peak season.

What is the main focus of the ITS Logistics October Port Rail Ramp Index?

The index focuses on port and rail ramp operations, highlighting continued low import volumes and the impact of new regulatory restrictions on non-domiciled commercial driver’s licenses that are affecting trucking capacity.

Why are import volumes significant in this report?

Import volumes have continued to decline, with September projected at 2.12 million TEUs down from 2.28 million TEUs in August, driving ports to tighten assessment of accessorial fees to capture revenue during peak season.

What regulatory change is impacting the trucking market?

The Federal Motor Carrier Safety Administration (FMCSA) issued an emergency interim ruling on September 26 restricting eligibility for non-domiciled CDLs, with states implementing enforcement efforts to verify CDL compliance and English language proficiency.

How will the CDL regulations affect carriers and capacity?

The regulations are expected to drive lower-cost capacity out of the market, increase financial insolvency risk for small and mid-size carriers, and potentially cause a surge in bankruptcies, particularly in the drayage market.

Who is most affected by these market changes?

Small and mid-size carriers, especially in the drayage market, are most affected, along with shippers who may face capacity challenges and need to carefully vet service provider health during RFP activities.

When are these regulatory changes taking effect?

The FMCSA issued the emergency interim ruling on September 26, and states have already begun implementing enforcement efforts at weigh stations, ports of entry, and major transportation routes.

What are the long-term implications for shippers?

Shippers should expect continued market disruption, reduced capacity, and increased importance of vetting service provider financial health during late 2025 and early 2026 RFP activities.

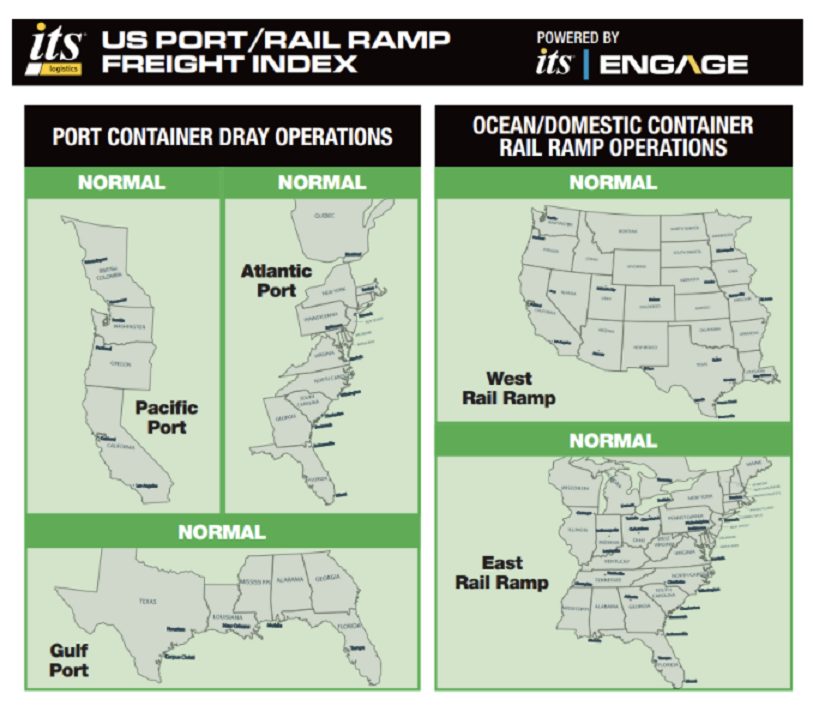

How are port and rail ramp operations currently performing?

Terminals and rail ramps are running smoothly without major challenges from inbound or export volumes, but regulatory pressures represent ‘storm clouds on the horizon’ for future operations.

What should shippers do in response to these market conditions?

Shippers should carefully vet service provider health and financial stability, particularly as they begin late 2025 and early 2026 RFP activity, given the increased risk of carrier bankruptcies.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 254003