AES Corporation Acquisition FAQ: Understanding the $38 Billion BlackRock/GIP Takeover News

Summary

Global Infrastructure Partners (now part of BlackRock) is preparing a $38 billion acquisition of AES Corporation, causing the stock to surge and erasing months of weakness in renewables-related stocks. However, the stock now trades near the rumored acquisition value, leaving limited upside for new investors while facing challenges including high debt, potential dividend cuts, and regulatory scrutiny.

What is the main news about AES Corporation?

Global Infrastructure Partners (now part of BlackRock) is preparing a $38 billion acquisition of AES Corporation, which has caused the stock price to surge significantly.

Why is AES Corporation an attractive acquisition target?

AES’s portfolio of subsidiaries provides scale and optionality for an infrastructure specialist like GIP, with non-recourse debt that allows risk to be ring-fenced and assets that would likely be more valuable under infrastructure consolidation than as a standalone public company.

What are the main concerns for investors considering buying AES stock now?

AES now trades near the rumored acquisition value, leaving little room for speculators to capitalize on a deal premium, and the stock is no longer cheap relative to fundamentals despite higher leverage, non-regulated exposure, and jurisdictional risk.

How does AES’s financial situation impact this acquisition?

AES carries heavy debt of more than $30 billion as of Q2 2025, which has suppressed its valuation, but ownership by a deep-pocketed sponsor like GIP would lower financing costs and improve credit terms.

What might happen to AES’s dividend under new ownership?

Under GIP’s ownership, dividend payouts would likely be curtailed to free capital for debt management and strategic repositioning, meaning current shareholders should not count on dividends continuing in their present form.

What regulatory challenges could this acquisition face?

While AES’s global footprint reduces single-jurisdiction blocking risk, U.S. regulators have been more aggressive in scrutinizing large infrastructure acquisitions, though the diversified portfolio should help smooth the approval process.

How does AES differ from traditional utility companies?

Unlike traditional regulated peers, AES derives most of its revenue from non-regulated operations, making its cash flows more volatile and less attractive to risk-averse investors.

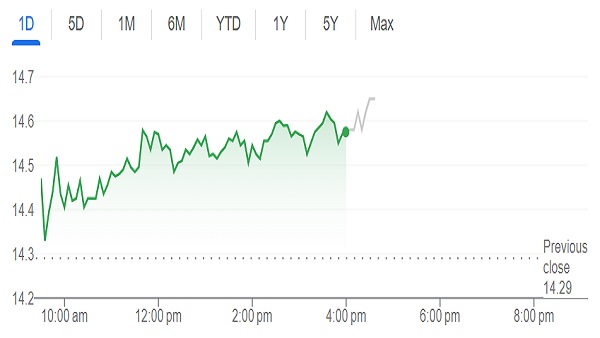

What is the current valuation situation for AES stock?

At yesterday’s close, AES’s enterprise value stood at roughly $39.9 billion, already above the $38 billion price tag mentioned in reports, suggesting traders have priced in not only the deal but potentially a small bump in value.

Why might AES management support this acquisition despite potential job losses?

Fiduciary duty obliges management to act in shareholders’ best interest, and attractive personal incentives could smooth the path toward approval despite consolidation potentially rendering some leadership layers redundant.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 243556