FAQ on ITS Logistics Q2 Index: Warehouse Space Tightens Amid Rising Vacancy Rates

Summary

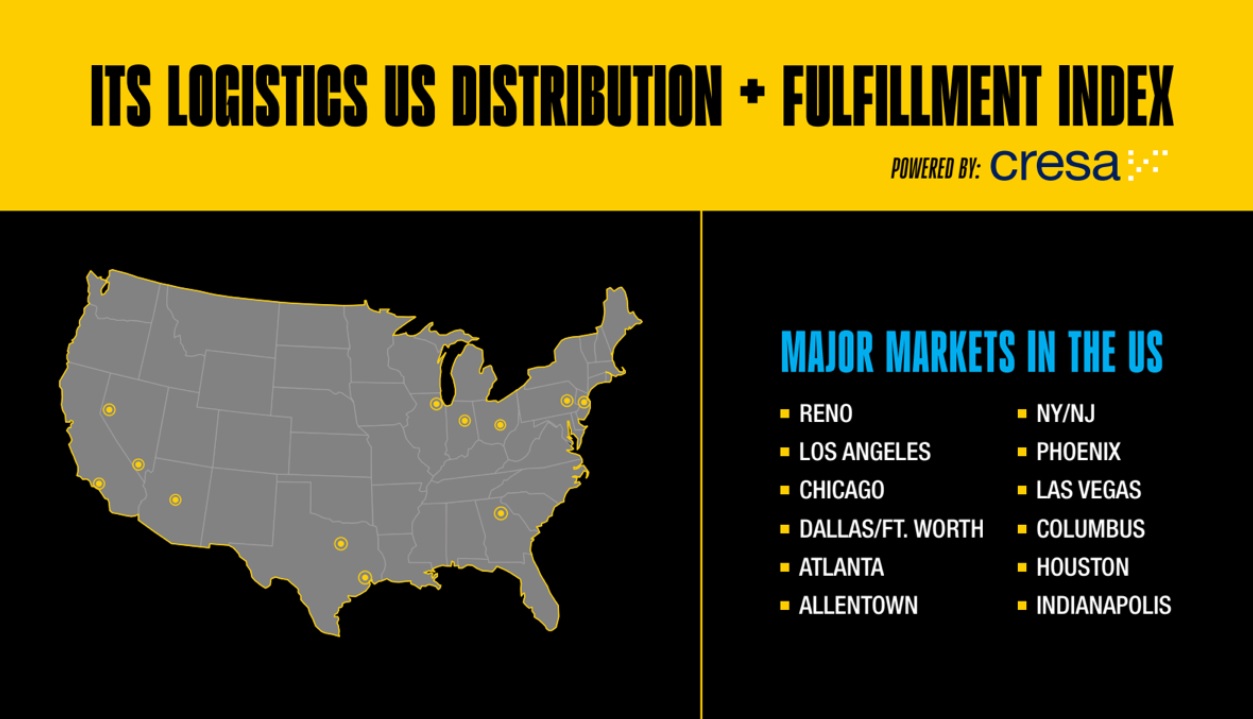

The Q2 ITS Logistics US Distribution and Fulfillment Index highlights tightening functional warehouse space and rising vacancy rates since 2014, impacting shippers and logistics providers with increased costs and operational challenges.

What is the main focus of the Q2 ITS Logistics US Distribution and Fulfillment Index?

The index focuses on the tightening of functional, operationally ready warehouse space and the highest vacancy rates since 2014, affecting shippers, retailers, and logistics providers.

Why are vacancy rates significant in the current warehousing market?

Vacancy rates climbing to 7.1%, the highest since 2014, indicate a tightening of functional warehouse space, impacting availability and costs for shippers and logistics providers.

How are inventory costs affecting the logistics sector?

Inventory costs surged to 80.9 on the Logistics Manager Index, the highest in over two years, driven by elevated labor, storage, and insurance expenses.

Who is most affected by the current warehousing market conditions?

Shippers, retailers, and logistics providers are most affected, facing challenges in securing operationally viable space and managing increased costs.

When are the impacts of these market conditions expected to intensify?

The pressure on capacity and costs is expected to intensify with seasonal inventory builds and consumer demand later in the year, moving into 2026.

Where is this tightening of warehouse space most evident?

The tightening is evident across the U.S., with national net absorption holding steady but new completions dropping to a five-year low, and vacancy rates rising above 7%.

What are the implications of the current warehousing market trends?

The trends imply increased challenges in securing functional space, higher costs, and the need for strategic planning to navigate the tightening market and economic uncertainties.

How does the current situation compare to previous years?

The current vacancy rates are the highest since 2014, with warehousing capacity contracting for the first time in over a year, and the slowest growth in average asking rents since early 2020.

What should shippers and logistics providers do in response to these market conditions?

They should act now to secure operationally viable space to be best positioned for 2026 and beyond, considering the expected intensification of capacity and cost pressures.

Who can provide more information on the Q2 ITS Logistics US Distribution and Fulfillment Index?

More information can be obtained from ITS Logistics through their website or by reviewing the Q2 ITS Logistics US Distribution and Fulfillment Index, Powered by Cresa.

This story is based on an article that was registered on the blockchain. The original source content used for this article is located at citybiz

Article Control ID: 135198